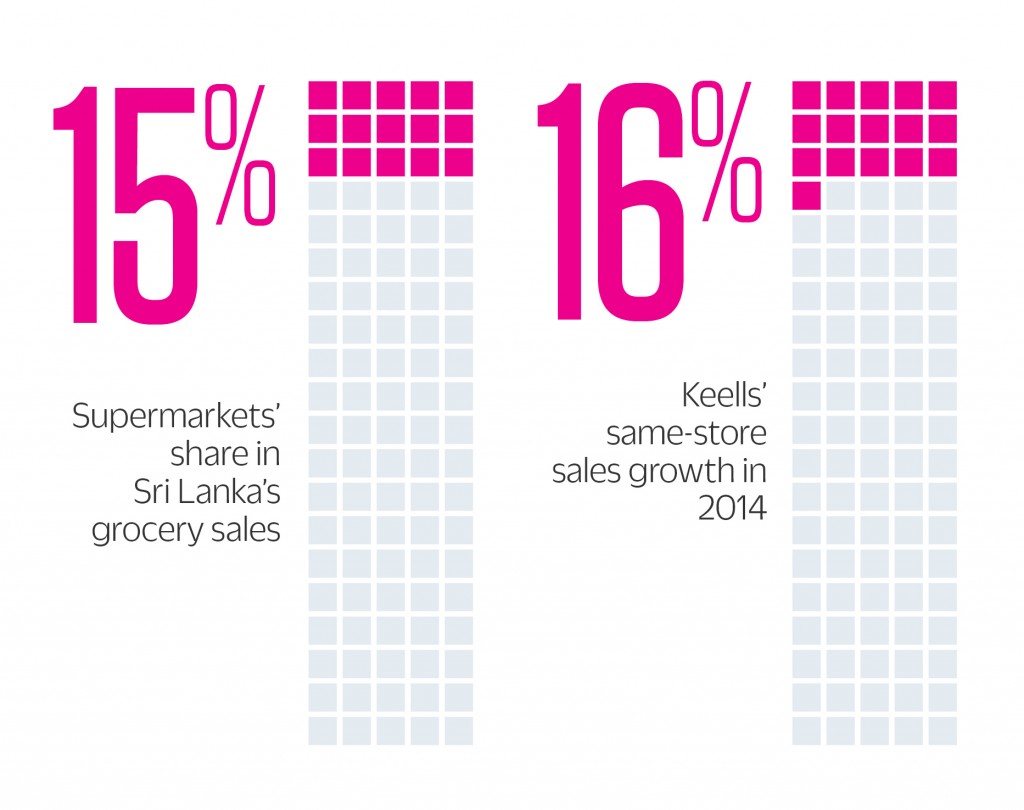

Food travels great distances before it reaches a dinner plate. Supermarkets’ importance in supply chains linking farmers to consumers has grown, as more people now rely on them for groceries and fresh food. Supermarkets account for over 15% of Sri Lanka’s grocery sales, and to grow this share they have to simultaneously cut prices and invest in more efficient supply chains. Lower prices narrow margins and the only way to beat this in the supermarket business is by growing business volumes.

A great deal of food is wasted in transit. Keells Super, a supermarket chain where listed John Keells Holdings is the ultimate parent, has remodeled outlets and tightened the supply chain to successfully reduce waste. So far, this year ‘same store sales (the major measure of industry growth) are up 16%. This is on top of a 10% rise in 2013, according to Keells Super Chief Executive Charitha Subasinghe.

Keells supemarkets target an affluent demographic compared to Cargills, which operates the largest chain of supermarkets in the country. Because Keells Super customers are more demanding, the outlets have to be swankier, have more parking space and huge displays of the widest possible choice of products. Unless managers somehow translate these investments in to higher sales, it will feed a vicious circle of out of control costs.

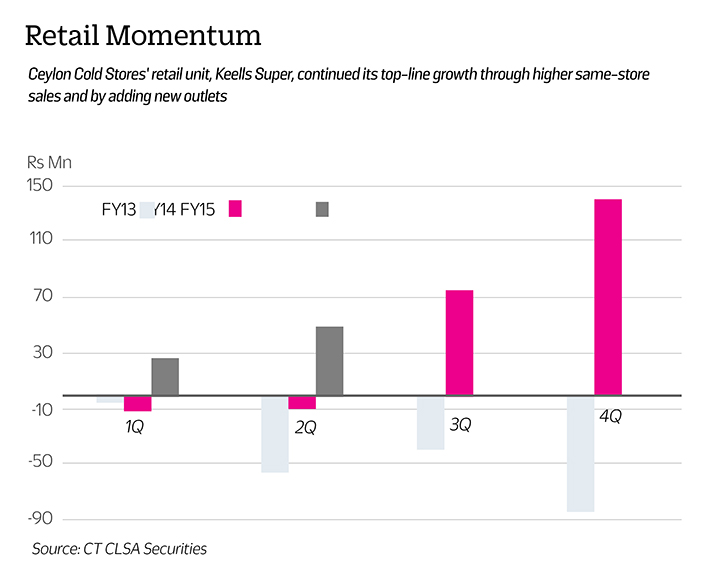

“Market share is what helps grow the bottom line. The margins are small and a tiny shift there can sway your business,” explains Subasinghe. In 2012 and 2013, manufacturers of fast moving consumer goods (FMCG) saw dips in volumes and sales, an unanticipated outturn. Those that still managed to grow revenue did so by increasing prices. In contrast to FMCG manufacturers, Keells supermarkets have met their volume targets over the past 4 years. Investments in new stores are also starting to now yield returns according to the Keells Super’s Chief Executive.

“This year (2014) has been good,bparticularly the last quarter,” Subasinghe points out, “we made changes over the past couple of years, specifically in store layout and processes. I wonder whether we have taken share from competition, because we have had double-digit growth.”

Innovation in Keells Super’s fresh produce supply chain now makes it possible to deliver vegetables to supermarkets within a day of harvesting. Better cold storage and displays have improved the quality of the fish and meats, while in-store bakeries using high-quality ingredients churn out freshly baked products that are now popular.

To minimize food wastage, which the industry calls ‘shrinkage’, Keels Super now uses plastic crates for transport and storage. Stacked one on top of the other, the crates prevent the load on top from crushing the food at the bottom. Keells operates farm collection centres at Thambuttegama, Suriyawewa and Nuwara Eliya, which enables it to source vegetables directly from farmers in those areas. The produce is transported to its packing and distribution centre located in Peliyagoda – a suburb of the capital – that operates round the clock, and food sorted there reaches stores early next morning, which is about a day after harvesting.

Taking longer and having more people handle it increase the risk that the food will either rot or be damaged in the supply chain. Shoppers avoid smashed tomatoes and withered leeks, and if they figure that fresher vegetables are available elsewhere would shop at those places instead. Keells operates a faster supply chain that also reduces human intervention – what Subasinghe refers to as a supply chain with fewer ‘touch points’.

It’s not clear how much of supermarket perishable supplies, including meats, are wasted. However, inventory management systems, cold storage, innovative processes and other paraphernalia have reduced shrinkage substantially from industry-wide levels over the last decade or so.

Subasinghe says that they have a clear understanding of what they are up against. As far as fresh fish is concerned, they compete against the local fish market where the morning’s catch is sold during the day. Because supermarket fish stock is frozen, it can be comparatively unappealing. So instead of displaying fish on the cold aluminum surface of a freezer, Keells Super outlets have added ice cubes and other paraphernalia to the displays, making them far more appealing to customers.

Its freshness strategy was extended to baked goods. “We haven’t cut corners on the ingredients we use there and customers appreciate this quality,” Subasinghe says about the bakeries located in most of their larger outlets.He says the firm is continuously growing its supplier base, covering a wide geographical reach. “This allows Keells a year-round steady supply chain.” By investing themselves or indirectly stimulating suppliers to adopt better practices, investing in factories and by eliminating layers of middlemen, supermarkets have improved the quality of products and supply chain efficiency. Subasinghe says a weak link is the lack of knowledge about best farming practices, which the firm is working closely with stakeholders to overcome. Keells Super also works with external parties to update farmers on better cultivation methods, preserving freshness and improving product quality. It expects suppliers to be able to meet its quality standards.

Eliminating middlemen by taking on those responsibilities is the most important contribution supermarkets make to local supply chains. The resulting savings are passed to consumers not as lower prices but indirectly as value additions like convenience and shopping comfort. Without an efficient supply chain, supermarkets will be unable to deliver on their promise of convenience and comfort in emerging markets like Sri Lanka. “You need to satisfy your customer. If you deliver on customer expectations, you will have their loyalty and you can attract many new customers. Our focus is to add value to the customer, whether it’s the fresh food or getting the basics right like cleanliness and a high service standard” Subasinghe stresses.

Sri Lankan farms are generally small and managed by an individual. Small scale imposes many cost-related challenges that ultimately result in waste and consumers having to pay high prices for food. Small farms are unable to access knowledge about best practices, up-to-date technology and state of the art machinery. As a result they are unable to be as productive as large farms. In Sri Lanka, the investments, knowledge transfers and innovation supermarkets have brought to the farming supply chain has to some extent neutralized the handicap of small, relatively unproductive Sri Lankan farms.

The supermarket supply chain model has no middlemen and, as a result, the same produce isn’t sold at multiple wholesale markets – increasing the rate of damage as it’s sorted, repacked and transported to multiple locations – before it reaches consumers. Supermarket supply chains also even out price variations caused by small swings in demand.

In a policy point of view, it makes sense for bureaucrats to create the conditions that allow supermarket-driven supply chains to widen their net. Because grocery sales are now segmented between supermarkets and a combination of corner stores and local markets, it was easier for the government to impose sales taxes on just the supermarkets in 2014. However, supermarkets were unable to increase prices by 12% to pass tax on to customers immediately, because sales tax didn’t apply to the rest of the retail trade. Supermarkets themselves absorbed some of the increased costs, while their suppliers were also asked to absorb the rest. Retail prices remained unchanged at first until suppliers to supermarkets increased them over time. Now, there is no longer a level playing field in the grocery business because only supermarkets are subject to VAT.

Keells Super’s margins were wiped off after VAT was introduced on the business. “We adjusted our model to manage within a reduced margin– top-line growth has helped,” according to Subasinghe. Keells supermarkets made a Rs49 million recurring net profit in the June quarter of 2014 versus a Rs10 million loss in the same quarter a year earlier. Quarterly profits peaked at nearly Rs150 million in the December quarter of 2013, after which VAT was imposed on supermarkets.By attacking shrinkage, Keells Super is improving its margins and building its ability to cast its supply chain net wider. While it has to build an overall national market share, how much of the local population shops at each store also matters. A fresher offering can be a real draw.