Attracting Not Just More, But Better Tourists

Extravagant trade fair displays, glitzy dancers and wine fuelled schmooze at tourism promotion events can’t offset harsh political realities. But this hasn’t stopped governments from spending lavishly at major tourism destination events to boost the country’s profile, in spite of realities like intolerance of dissent or an amnesiac approach to recent history. For someone overseas […]

Extravagant trade fair displays, glitzy dancers and wine fuelled schmooze at tourism promotion events can’t offset harsh political realities. But this hasn’t stopped governments from spending lavishly at major tourism destination events to boost the country’s profile, in spite of realities like intolerance of dissent or an amnesiac approach to recent history.

For someone overseas what’s the first thought that comes to mind about Sri Lanka? A spectacular Adam’s Peak sunrise…?, how holy shrines & temples blend with Kandy’s colonial edifices…?, the beautiful azure beaches or 122 mm cannon fire, tanks, jack boots and a bloody end to a long conflict?

People’s views of foreign countries are deeply rooted and often formed by their awareness of political realities in those places. The first thoughts of someone overseas of Sri Lanka are likely to be the conflict and its bloody conclusion. They will remember the recent and surprising political change and those with longer recollections may remember the jailing of a challenger who lost the 2009 presidential election.

…They came from the East

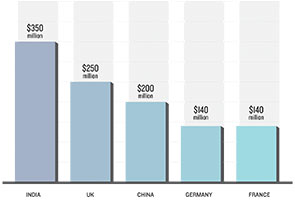

Sri Lanka’s tourism industry is earning more from China and India than from its traditional markets in the West. Top 5 spenders in 2014

The unfavorable idiosyncrasies and stereotypes are quickly etched in people’s minds. Regular rebukes by international bodies that scrutinize national rights records renew these unfavorable opinions.

Most countries disagree with the outside world’s perception of them. There are two ways a country’s image can change for the better. The first is luck, like Sri Lanka winning the cricket world cup, which would have endeared the island in the minds of cricket fans. But there is little sense putting luck at the centre of any strategy.

Secondly, a country’s ability to innovate; become a centre for arts and culture, develop a reputation as a cosmopolitan destination, a place for conferences and have a leadership that wins global plaudits, can contribute to changing perceptions. This transition often takes years.

However it’s tempting to spend tax money trying to put perceptions right immediately. An improvement can boost tourism and foreign investment, both desirable short-term outcomes. The tourism sector is demanding an engaging promotion campaign in the markets with the greatest potential. A successful strategy should deliver a consistent and focused message after figuring what about Sri Lanka is sellable to the target market.

Image polishing (to showcase foreign investment potential) and country promotion can highlight aspects overlooked in the predominance of political realities. If the image polishing campaign promises stable policy to foreign investors; the government better not impose overnight tax changes; similarly if it promises smiles to tourists, people better not be frowning.

The high paid consultants will soon arrive to ask focus groups such questions as, “what brand of phone would Sri Lanka use if it were a person?, what car it would drive and perhaps if it would prefer a sarong instead of chinos for a casual evening out?.”They will figure out a country’s persona first before distilling this offering in to a promotional campaign.

The mystical allure of the destination emerging from a long conflict has been enough to keep tourist arrivals growing at double-digit rates in the last five years. Capitalizing on the historic destination marketing opportunity now facing Sri Lanka through a well thought out promotional campaign is the first of four challenges facing a new promotional strategy. Few countries with so much potential exist relatively undiscovered. Most undiscovered places are either conflict or extreme poverty wracked that few tourists would venture. The popular destinations are overcrowded and expensive.

Sri Lanka’s share of the 1.1 billion global tourism pie is a mere 0.12%. Surely there is potential to grab a bigger slice. However the island’s recent promotions are amateurish. They have focused on staging dance performances at Chinese shopping malls and printing Sri Lankan wildlife and beach images on buses in China carrying a ‘Visit Sri Lanka’ slogan.

Sri Lanka is at a sweet spot because its world-class attractions are relatively undiscovered. Its circumstances deserves a focused effort than the current one under the ‘Visit Sri Lanka’ theme and the accompanying drum beating at Chinese shopping malls.

Those who insist the Chinese strategy is successful, because that market is now Sri Lanka’s biggest tourist source, are missing the point. More Chinese can afford to travel overseas on holiday than can –say Indians – so it’s the ripest big market to tap. Chinese travel agents will generate planeloads of tour groups, as is now happening, but they may not be the best visitors. Not all tourists are equal and attracting discerning and modern travellers is the second destination promotional challenge. Chinese tourists the convoluted messaging attracts are not the most discerning.

Those who insist the Chinese strategy is successful, because that market is now Sri Lanka’s biggest tourist source, are missing the point. More Chinese can afford to travel overseas on holiday than can –say Indians – so it’s the ripest big market to tap. Chinese travel agents will generate planeloads of tour groups, as is now happening, but they may not be the best visitors. Not all tourists are equal and attracting discerning and modern travellers is the second destination promotional challenge. Chinese tourists the convoluted messaging attracts are not the most discerning.

Sri Lanka can be promoted for its pure scenery, unique gastronomy, proud history, and wildlife. But branding an entire country along such broad terms can be rather reductive. Every country confused about how it should be perceived makes these broad, stereotypical claims. Few destinations can be everything to everybody; emerging ones will struggle particularly with such wide-ranging claims.

In emerging destinations scenery is often inaccessible due to poor roads, untrained restaurateurs serve mediocre meals, lack of information and access make historical monuments uninteresting and visitors to wildlife reserves suffer the ills of deforestation and traffic jams. The notion of branding an entire country can be rather superfluous. Destination marketing on the other hand is about infusing some fun in to a consistent message to sway more travellers its way.

Sri Lanka’s tourism promotion targets are simplistic; their only goal being visitors. Growing arrivals is

important; it will fill hotels, restaurants and maintains momentum. However discerning travelers will boost industry competitiveness, enhance the destination’s attractiveness and create a buzz.

It’s easy to criticize the state’s destination promotion backwardness. But the industry itself hasn’t been very creative. Modern travellers are well informed and experiential holiday offers are more likely to appeal to them. Sri Lankan’s decades old destination focused package tourism itineraries are unsuited for modern travellers who choose the experience first and then figure where to holiday.

Discerning, demanding modern travellers also pay premiums compared to mass package tourists. Singapore is a fine example of a successful experiential destination. Its 15 million annual visitors spend thrice as much, per person, as do Malaysia’s 24 million annual visitors. Some inbound tour operators, hotel chains and other industry players offer limited experiential options. Itinerates have to appeal to specific markets; an Indian family keen to strengthen family bonds, European empty nesters discovering the island’s colonial past or middle eastern travellers looking for a culture sensitive luxury break.

Discerning, demanding modern travellers also pay premiums compared to mass package tourists. Singapore is a fine example of a successful experiential destination. Its 15 million annual visitors spend thrice as much, per person, as do Malaysia’s 24 million annual visitors. Some inbound tour operators, hotel chains and other industry players offer limited experiential options. Itinerates have to appeal to specific markets; an Indian family keen to strengthen family bonds, European empty nesters discovering the island’s colonial past or middle eastern travellers looking for a culture sensitive luxury break.

Singapore’s high yield success is due to its innovating around experiential travel and promoting specific propositions to its various top tourism generating markets. Singapore’s top markets, so called ‘cash cows’, are China, India and Indonesia. Here it targets leisure, business and MICE tourism. The focus is on growing yield and numbers.

Due to their potential Singapore invests in a second group, the so-called ‘stars’, including Japan and Vietnam. These markets also generate medical and education related travellers. The third category is niche markets like the Middle East and Russia from where the Singapore tourism authority targets luxury travellers, cultural & heritage tourists and senior travellers.

A new Sri Lankan promotional strategy should similarly segment the market. Sri Lanka’s likely future cash cows are India and China, generating the most visitors and plenty of conference and incentive related travel. The stars will include Western European ones like UK, Germany and France where travellers will demand value addition. Niches are likely the Middle Eastern region and some Eastern European states.

A new Sri Lankan promotional strategy should similarly segment the market. Sri Lanka’s likely future cash cows are India and China, generating the most visitors and plenty of conference and incentive related travel. The stars will include Western European ones like UK, Germany and France where travellers will demand value addition. Niches are likely the Middle Eastern region and some Eastern European states.

Successful promotional campaigns in each of these markets should highlight the experiential value with specific propositions. This is also connected to the third challenge a promotional campaign should address, improving yield.

In 2014 the industry earned a record$1.7 billion with India contributing $350 million, UK $ 250 million, China $200 million and Germany & France $140 million each. These top five account for 60% of earnings. Tourism earnings now rival those of tea and if its post conflict double-digit growth continues, in five years the industry could become Sri Lanka’s top foreign exchange earner.

High spending travelers won’t arrive here by accident because they extensively research destinations before visiting. They often fall in to the Free and Independent Travellers (FIT) category. The spiritual, wellness and consumerist segment dominated by women fall in to the FIT category. Appealing to FITs requires creativity. While Sri Lanka will struggle to deliver on consumerist expectations, it can around health and wellness.

The fourth challenge –of being digital savvy – stems from the need for higher yields. High spenders are most likely to discover and explore a potential holiday or business destination online before they decide to travel. Increasingly that digital device is likely a mobile gadget. Sri Lanka’s digital tourism promotion is weak and it hasn’t discovered mobile at all.

Instead the industry depends on fading promotional strategies like inviting journalists to write about a destination. Travel journalists are irredeemably corrupt hacks. Writers accept free air tickets and hotel stays in exchange for a glowing copy about a destination. Most smart travellers recognize that and look for reviews from others who have travelled before instead. Users share reviews with friends and on online communities.

Instead the industry depends on fading promotional strategies like inviting journalists to write about a destination. Travel journalists are irredeemably corrupt hacks. Writers accept free air tickets and hotel stays in exchange for a glowing copy about a destination. Most smart travellers recognize that and look for reviews from others who have travelled before instead. Users share reviews with friends and on online communities.

Growing Sri Lanka’s tourism arrivals isn’t such a difficult task anymore and shouldn’t be the sole focus of a promotional campaign. Incorporating other qualitative and quantitative targets in to campaign outcomes requires a realignment of priorities. Focused destination marketing will not just help attract more but also better tourists.