Shopping Malls: Ripe for Investment

Colombo’s last big shopping mall, Crescat Boulevard, opened for business a decade ago. For a city that’s aspiring to be South Asia’s most cosmopolitan, traveller friendly metropolis that its retail infrastructure is woefully lacking is now glaringly obvious. A real estate services firm, Jones Lang LaSalle, which has been servicing owners, investors and occupiers of […]

Colombo’s last big shopping mall, Crescat Boulevard, opened for business a decade ago. For a city that’s aspiring to be South Asia’s most cosmopolitan, traveller friendly metropolis that its retail infrastructure is woefully lacking is now glaringly obvious. A real estate services firm, Jones Lang LaSalle, which has been servicing owners, investors and occupiers of real estate globally forecasts demand for shopping mall square footage outstrips supply by more than three times in Sri Lanka. During the next three years, when no significant retail shopping space is expected to be added, the demand gap will rise to four times the available space, Jones Lang LaSalle’s Colombo office says in a new report on the island’s retail sector.

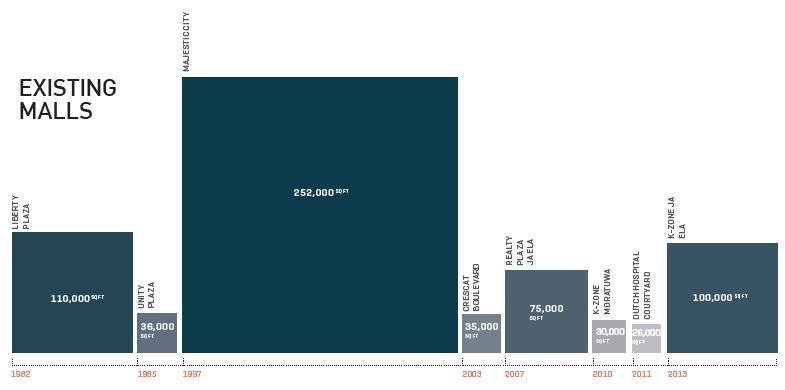

For two decades high building costs and weak demand had put a lid on major retail real estate development projects. The three percent of retail sales accounted for by the organised sector in the island now lags behind even India. Sri Lanka’s per capita shopping mall stock is also one the lowest among emerging Asian cities.

However new shopping centers will have to be more ambitious to take advantage of the opportunity to become destinations in their own right with a mix of brands, restaurants, various other leisure facilities, grocery shopping, good location and easy access off busy highways, to be successful. Around a quarter of the space available in destination malls are used for entertainment.

Developers constructing these next waves of destination shopping malls early will be able to benefit from higher rents due to pent up demand driven footfall. Jones Lang LaSalle’s Chief Operating Officer for the Asia Pacific Albert Ovidi and the Chairperson of Sri Lanka operations Gagan Singh discussed the highlights of the firm’s retail shopping space report.

What’s the opportunity in retail that you see in Sri Lanka?

Albert: For an international firm like us the stability in Sri Lanka is very attractive, since there is energy in the market. The opportunities are definitely here, and as a country there is definitely the willingness with free trade agreements and foreign investment.

We see this as a good active market with great potential. If we look at the call for retail if you like in Sri Lanka, Tourism at the moment is nearly 4% of the GDP, per capita income last year was $2900. Unemployment has dropped to 5% so you’ve got this nice mix of tourists spending money, locals with more money to spend and, government stability. As demand for retail increases people will need more retail space around it.

The other thing of note from the report is the Sri Lanka retail market is estimated between $25-30 billion, but only 3% is under organized retail. In Colombo we see that there are hyper markets and supermarkets but it doesn’t have these destination malls with entertainment and food. We think Colombo can probably take about 2.4 million square feet of malls but only has 700,000 square feet and none of them cater to the total mix.

Q: You’ve identified this huge gap in retail but what does this mean to developers and other stakeholders?

Albert: As we see in a market at this stage when it’s such a low percentage of organized retail it’s working out the changing demographics it’s what they are going to want in destination shop. It’s not just hypermarkets and supermarkets it’s really looking at the format; probably larger formats with mixed use. So for developers it’s going to be about choosing the right demographics, the right locations now looking at the right formats for this market and this consumer and then you look at what brands you want. Sometimes we find things can be brand. It’s also possible that malls end up with the same brand in every one so the malls don’t look too different.

Gagan: So taking off from there that’s absolutely right given the size of the country. We can’t copy other countries and say everyone should have one million square foot plus malls. It has to be a size and positioning that suits the scale over here. Sri Lanka shouldn’t be scared of having a modern mall, the destination kind of mall, because that is what is required. So it’s got to be well positioned, well located, the right size and have the correct mix. We need two or three good malls for Colombo and they are sure to do well.

You have identified a massive shortfall. Looking at the mall space that is planned do you still think there will continue to be a gap some years from now?

Gagan: There is a gap because looking at what’s on the drawing board and assuming everything gets delivered we will reach 1.1 million square feet in four years. We are saying the demand is more than 2.4 million square feet. A lot of what’s planned are high end except for the neighbourhood malls. The Shangri-la, Altair, ITC are all very high end. We are talking about two or three destination malls. None of them are planned at the moment.

Can you define a destination mall?

Albert: The gap, you see is what about the normal consumer who wants to go to a shopping centre? Purchase groceries while at the same time go have some lunch there, take the kids to a movie, do some fashion shopping but all in one location. You don’t have to go to the supermarket, come back and decide to go to the movies and come back and go eat elsewhere. Once you are there you can actually spend your day and the customers stay longer because it’s more convenient.

And these don’t necessarily have to be in downtown Colombo?

Gagan: They don’t necessarily have to be in downtown Colombo but I’m guessing the Glennie Street project (JKH) is being thought out as a destination mall, because they are thinking of a casino and then retail next to it. That becomes an even bigger destination.

So this new plan that the government has of promoting large casinos, not the small types that don’t even put their names outside, if that happens it’s going to be a whole new reason for people to stay on in Colombo and not just leave for their holiday to Kandy or to Galle.

Colombo has a rich mix for tourism, from the beaches to heritage and history and Buddhism and now adding casinos to this small place. All that’s missing here is entertainment and shopping.

Of the developments that are underway, besides JKH you don’t think any of the others are meeting the criteria of being destination malls?

Gagan: I think The Colombo City Centre by Abans and Silverneedle have a possibility. Altair won’t because it’s only 40,000 square feet. Krrish I don’t know. Shangri-La will not. It will be high end luxury and it’s positioned that way.

What about Havelock City?

Gagan: Havelock yes. But it’s not downtown so I’m not counting it.

This gap in retail space you identify is not necessarily downtown or Colombo centric?

Gagan: It’s the whole of Sri Lanka.

So anybody who quickly moves can anticipate higher than normal returns for a few years?

Albert: It’s all about getting the footfall. There are a few things you need to get right. It has to be in the right catchment to get the right customer. Sometimes we’ve seen malls that have opened when they are half ready and the word of mouth hasn’t been positive. It’s a combination of these things – the right mix, launched the right way, with the right positioning and marketing.

They do this by getting the anchor tenants in first and making sure you have to walk past the non anchor tenants to get to them. So that way the non anchor tenants should experience better footfall in front of their shops and better sales.

Gagan: It’s the first mover advantage. Whoever comes with the first one and comes up fast and does a good job is really going to cash in.

What about the existing product?

Gagan: Because of the shortage of space the existing product is so cramped because everyone wants to be there. So you don’t have the space and the opportunity to really capitalize on that to make it a pleasure. The biggest problem we face as real estate service providers in Sri Lanka is everyone wants good retail space and there is none to be had. There is not even enough high street space because everyone’s picked it up.

There are brands that are asking us for 20,000 square foot floor space in prime areas of Colombo but we can’t find it. You’ll get maybe 5000 square feet, no one wants to go four floors up. Once all these developers come the existing product will become better because they will have space.

How about returns in this business?

Albert: It does take a bit longer for returns to come through. But you’ve got to have that right mix, the right positioning, the right marketing.

Gagan: You also have to get the simple things right, like where an escalator is located, where your anchor tenants are located or where you put the coffee shop. It makes a difference because you have to make sure the flow of traffic happens, that it’s a pleasure and that your conversion rates increase. It’s not the same as creating an office space or creating a hospital because it is an art and a science to get it right and that is what makes the difference between a very successful mall and an ok mall.

Albert: We’ve seen some malls that become so popular that it takes half an hour to get to the car park. That becomes part of the planning process.

Gagan: At neighbourhood malls to get the women in, they have cooking lessons, they have morning walks for the elderly and yoga lessons before the mall opens. In the centre of town you will have good music; you could during the holidays have activities for children and different things during Christmas season.

Albert: For investors it’s also about how they set up their leases. Leases become a little bit more sophisticated. An anchor tenant may get a very cheap rent depending on how big they are, who they are etc and others may not. There are also turnover rents, what we call revenue share, and then in the chargers they can be separate marketing chargers that tenants have to pay. The formal relationship between the landlord and the tenants is more organized and it’s clearly discussed so everyone knows what they are getting into. There is more depth to lease agreements in these bigger malls. And revenue share has become a very common thing.

How does revenue share work?

Gagan: Your rent is linked to the revenue and in a good month you pay higher rent and in a bad month you pay the minimum rent. So therefore the developer becomes a stakeholder in the business. But of course you need transparency and clear systems and processors for your building.

Is this supply gap a unique thing to Sri Lanka? Or are similar gaps common?

Gagan: In emerging economies it’s common. If you go back 10 years India had a similar experience. Only three percent of retail happening in the organised sector is also not unique. But in India more retail now happens in the organised sector. However if you look at the per capital mall stock you see that Colombo is particularly low if you compare with Kochi in India for instance. Colombo has a higher per capita GDP but the mall space, per capita, is much higher in Kochi. Colombo is an outlier.

Are retail rents attractive enough for developers?

Gagan: Retail rents are decent and aren’t low compared to office space rents. Given the high construction costs in Sri Lanka office rents still don’t give a decent yield. That’s why there are no office buildings coming up.

Why are construction costs unusually high here?

Gagan: Everything is imported and the duties are high. The cost of labour is also high. Even with the tax breaks that big projects get, construction costs are still high.

So why doesn’t that translate in the same way to retail?

Gagan: Because in retail they are managing to command the rent. In office space people are not accepting the rents and finding alternatives. In the World Trade Center for instance so many companies that have been here on low rent, even global firms, want to move out when rents rise. They can afford it but they are not used to it and they are not accepting it.

Albert: In the Global Retail Development Index Sri Lanka went from 20th to 15th between 2011 and 2012 and in 2013 looks like it’ll be around the same. That’s talking about the best countries for retail investments.

Gagan: I’m not surprised at the fear to get into this space because having been in India when the first few malls came everyone thought the rents they demanded were ridiculous. But it just took off and now you have excellent malls. Of course they have to be leased malls and not sold outright, otherwise they can never be successful.