The iKman Bird Gets the Worm

Free online classifieds site Craigslist has disrupted newspaper classifieds sales in the US the same way online retailers Amazon and eBay have dented the revenue of brick-and-mortar retail stores. ikman.lk has brought this same disruption to Sri Lankan commerce, rapidly moving consumers from offline to online market spaces. Once the first mover in an online […]

Free online classifieds site Craigslist has disrupted newspaper classifieds sales in the US the same way online retailers Amazon and eBay have dented the revenue of brick-and-mortar retail stores. ikman.lk has brought this same disruption to Sri Lankan commerce, rapidly moving consumers from offline to online market spaces.

Once the first mover in an online classifieds market captures the majority market share, it is difficult to dislodge it from its #1 position, as consumers would want to post on the most popular site. Most mature markets have a clear winner, with the #2 dying down. In the US, Craigslist dominates (it is also present in many other mature markets and is the global leader), while Gumtree holds forth in the UK and Australia, Blocket in Sweden and leboncoin in France. Other ecommerce platforms usually have several top players, but the number is limited.

This is driving developed market incubators towards emerging markets to copy these tried-and-tested models. ikman got in early on the online classifieds game in Sri Lanka, launching its website in mid-2012. It unleashed a marketing blitz on media platforms that have almost total penetration in Sri Lanka – television, radio and print – and rapidly gained traction. By the time local companies began launching competitor sites, it was too late. In recent months, a number of foreign companies have also launched similar sites, but whether they’ll be able to catch up with ikman is doubtful.

This is driving developed market incubators towards emerging markets to copy these tried-and-tested models. ikman got in early on the online classifieds game in Sri Lanka, launching its website in mid-2012. It unleashed a marketing blitz on media platforms that have almost total penetration in Sri Lanka – television, radio and print – and rapidly gained traction. By the time local companies began launching competitor sites, it was too late. In recent months, a number of foreign companies have also launched similar sites, but whether they’ll be able to catch up with ikman is doubtful.

Commerce began making the offline-to-online move in developed markets a couple of decades ago, and today ecommerce markets in these countries are extremely competitive. In the face of this, developed market incubators have begun funding and applying concepts proven in their markets to more immature ones, and this trend is now growing rapidly. It is a business model that has high potential in countries where digital economies are only just emerging.

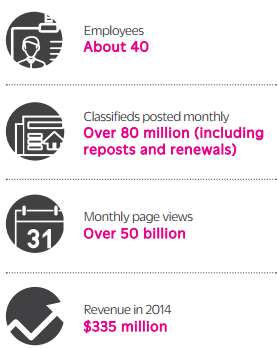

In this Internet era, some of these companies don’t even have a physical presence in the emerging markets, but work from their home bases. ikman’s start was similar. Swedish investment company Saltside launched the site from Gothenberg, Sweden in mid-2012, with absolutely no physical presence locally. After eight months of rapid growth, the company hired current ikman head Alexander Lowback to set up operations in Sri Lanka. Initially, he worked from his apartment in Colombo, but today ikman occupies two floors in a Borella office building and employs 110 people.

Pa rtnering with local advertising firm Phoenix Ogilvy, the company initially spent millions on a torrent of advertisements, followed by online marketing and support. As the initial marketing gained it a large market share, ikman has been able to tone down its campaign. Word of mouth has done the rest of the work.

rtnering with local advertising firm Phoenix Ogilvy, the company initially spent millions on a torrent of advertisements, followed by online marketing and support. As the initial marketing gained it a large market share, ikman has been able to tone down its campaign. Word of mouth has done the rest of the work.

Browsing ikman can bring up ads posted from Dehiatthakandiya to Mullaitivu. ikman’s annual research consistently shows that ad postings follow Internet penetration, with the most ads posted from the Western Province, followed by the south and central areas. The surveys also show that even in the most rural areas, people are aware of the website. ikman has empowered these rural folk who didn’t have access to a vast marketplace just a few years ago, but now do, sometimes using just low-cost feature phones.

The strange thing is that it’s all run by a Swede. Tall, blonde and blue-eyed, Alex stands out among his all-Sri Lankan staff. But he is clearly aware of the way his Sri Lankan consumers think and how the company can reach them.

Alex says most of ikman’s visitors are from Sri Lanka. Amazon’s web traffic data subsidiary Alexa estimates two-thirds of ikman’s visitors to be from Sri Lanka, but since this site captures only desktop visitors and two-thirds of ikman’s visitors access the site on mobile platforms, Alexa doesn’t provide a useful gauge of overall visitors.

Alex says most of ikman’s visitors are from Sri Lanka. Amazon’s web traffic data subsidiary Alexa estimates two-thirds of ikman’s visitors to be from Sri Lanka, but since this site captures only desktop visitors and two-thirds of ikman’s visitors access the site on mobile platforms, Alexa doesn’t provide a useful gauge of overall visitors.

A more interesting statistic is the high number of visitors Alexa shows from South Korea, Singapore and the UAE, countries with a substantial number of Sri Lankan migrant workers, and the Maldives, where ikman is the 14th most visited desktop site.

Saltside is also the owner of Bikroy.com in Bangladesh and Tonaton.com in Ghana. ikman was developed by an ex-Skype employee, and the company aims to continue building online marketplaces in unsaturated markets.

Companies in developed countries that launch consumer websites in immature markets are now a dime a dozen. Rocket Internet is perhaps the most known and successful. Started in 1999 by three German brothers, the company has launched consumer sites in countries from Italy to Brazil to Indonesia, conquering market after market. Just as these sites start becoming big, the company sells them, usually making millions in profit. Buyers range from eBay to Groupon and Facebook.

Rocket Internet recently entered Sri Lanka and runs the property site Lamudi, vehicle site Carmudi and online marketplace Kaymu. But can they eat into ikman’s market share? Last month, ikman attracted close to 2.8 million unique visitors, 200,000 new ads and 135 million page views. According to Alexa’s rankings, it is the sixth-most visited site in Sri Lanka on desktop computers, behind the usual suspects like Google, Facebook and YouTube (and, uniquely to Sri Lanka, espncricinfo) and the most visited local content website. Rocket’s most visited site on the Alexa list, kaymu, is ranked at 141.

Rocket Internet recently entered Sri Lanka and runs the property site Lamudi, vehicle site Carmudi and online marketplace Kaymu. But can they eat into ikman’s market share? Last month, ikman attracted close to 2.8 million unique visitors, 200,000 new ads and 135 million page views. According to Alexa’s rankings, it is the sixth-most visited site in Sri Lanka on desktop computers, behind the usual suspects like Google, Facebook and YouTube (and, uniquely to Sri Lanka, espncricinfo) and the most visited local content website. Rocket’s most visited site on the Alexa list, kaymu, is ranked at 141.

Gauging a classified website’s success in terms of visitors or the number of ads is easy, but the success of its end goal, the selling of a product, is much harder to test. There is no clear way to do so. Alex says the only way is from the thank you mails the site receives or from ad deletions. But not everyone sends a thank you and not everyone deletes an ad once they sell an item, so this is an incomplete system.

Gauging a classified website’s success in terms of visitors or the number of ads is easy, but the success of its end goal, the selling of a product, is much harder to test. There is no clear way to do so. Alex says the only way is from the thank you mails the site receives or from ad deletions. But not everyone sends a thank you and not everyone deletes an ad once they sell an item, so this is an incomplete system.

ikman’s closest current competitor is not a website, but The Sunday Times’ classifieds supplement HitAds. Global giants have not threatened ikman, even with the recent entry of Rocket. Other sites trying to capture market share are all local and haven’t gained traction anywhere near ikman’s level. None of these local classifieds are in Alexa’s top 50 sites visited in Sri Lanka. In contrast, the company faces a polar opposite scenario in Bangladesh, with a few global giants tussling for market share. The presence of developed-marketincubator websites is low in Sri Lanka, perhaps because there is less opportunity here due to the lower population. These investors usually target highly populated markets with moderate economic infrastructures and immature Internet commerce. In this context, Saltside’s venture into Sri Lanka was a risk. But it has proven to be worthy. Of the company’s three sites, ikman has been the most successful. Alex believes this success is due to the country’s tradition of classifieds.  “Everyone knows the concept, it’s nothing new,” he says. “Some markets haven’t had this tradition of newspaper ads. But here it’s just a matter of taking it from offline to online.”

“Everyone knows the concept, it’s nothing new,” he says. “Some markets haven’t had this tradition of newspaper ads. But here it’s just a matter of taking it from offline to online.”

Although Sri Lanka’s population is low, its 20% Internet penetration is high compared with other emerging markets. ikman has grown rapidly in the almost three years since its launch, but with 2.8 million unique monthly visitors, it now has to wait for further Internet penetration for its market to grow. Alex estimates current penetration at five million, but thinks regular Internet users may be closer to three and a half million. He expects Internet penetration to boom in the coming years.

Two out of three ikman visitors access the site on their mobile phones, another rapidly growing area, while desktop ownership numbers are stable and growth is limited. To keep pace with growth, the company has expanded from one employee to 110 in less than two years, and today all of its divisions are hiring.

Companies naturally want to enter emerging markets where smartphone usage and Internet penetration double or triple within a matter of years. New addressable markets open up rapidly. Many developed market companies are looking at Asia, particularly Indonesia with its over quarter billion population. OLX, or OnLine Exchange, a classifieds company present in more than 30 countries – mostly emerging markets – is Indonesia’s most visited classifieds website on the desktop, but several other foreign-owned sites are present too.

Worldwide, online classifieds sites have begun killing newspaper classifieds. US newspaper classifieds revenue fell 70% from $19.6 billion to $6 billion in the decade ending 2010. Affected newspaper groups are now fighting back. With its classifieds revenue declining, Singapore Press Holdings, the owner of over 10 newspapers, launched several online sites in 2012 for employment, property and general classifieds. These saw resounding success. Schibsted, the publisher of several Swedish and Norwegian newspapers, is also aggressively pursuing online classifieds. It has taken the Blocket model worldwide. South African media giant Naspers has adopted a similar strategy, buying into China’s TenCent and launching global classifieds sites. HitAds is available online, but Alex thinks the site hasn’t been a success, with its print classifieds much more in demand.

Alex is unsure whether ikman has eaten into Sri Lankan newspaper classifieds. “I can’t say I’ve seen it happening, but I hope it is,” he says. Then, speaking of a particular newspaper group, he adds, “I assume we are because I know they’re not very happy with me; they never run my PR articles, and they don’t let me do print ads. So they see the threat.”

Alex is unsure whether ikman has eaten into Sri Lankan newspaper classifieds. “I can’t say I’ve seen it happening, but I hope it is,” he says. Then, speaking of a particular newspaper group, he adds, “I assume we are because I know they’re not very happy with me; they never run my PR articles, and they don’t let me do print ads. So they see the threat.”

ikman’s Swedish headquarters handles all site development, while this and the Dubai office do online marketing in collaboration with agencies. The Colombo office handles all the ground work. A team of 30 to 35 works around the clock to manually approve the 15,000 or so ads posted daily throughout the day. The team follows extensive guidelines, screening everything from simple errors – such as posting a bike on the car page – to fraud and illegal items. It also investigates any reported ads. The team does not, however, check the ads for quality or accuracy. “We don’t have the manpower to fix it all,” says Alex. “We try to fix what we can, the serious stuff. At the end of the day, people will get educated. They’ll see that the better the ad they post – if they spell it correctly or post a nice picture – the quicker they sell their item and at a higher price. But it takes time.”

Media may be rife with reports of fraud and crime on classified websites worldwide, but ikman has faced little trouble in Sri Lanka. “In general, if we look at the markets we operate in, we don’t have the fraud issue in Sri Lanka,” says Alex. “People are very honest and decent here. In Africa, fraud is a pretty big thing on the site. There is a big problem.” A couple of times, however, the Sri Lanka police have asked the company to help track stolen goods posted on the site. ikman has faced pranks more than fraud or crime in Sri Lanka. Pranksters post ads with someone else’s phone number and, in a few such cases, the police become involved, as the victim calls them instead of the ikman helpline. Alex also mentions pranks in which people post ads to sell a friend or their wife. The Colombo office also houses a 10-member marketing team focused on selling banner ads. Multinationals and banks have come onboard due to ikman’s visitor numbers. Financing and leasing companies, as well as banks, advertise on the vehicle and property pages, as they target a similar market. While this team brings in revenue, the latter task is not ikman’s main focus. Rather, it is maintaining its #1 position and growing with Internet penetration. But ikman is introducing revenue earners gradually. Currently, the top ads feature is its other earner, wherein users can pay to have their ad bumped to the top of the page, above the other hundreds posted on the site.

Media may be rife with reports of fraud and crime on classified websites worldwide, but ikman has faced little trouble in Sri Lanka. “In general, if we look at the markets we operate in, we don’t have the fraud issue in Sri Lanka,” says Alex. “People are very honest and decent here. In Africa, fraud is a pretty big thing on the site. There is a big problem.” A couple of times, however, the Sri Lanka police have asked the company to help track stolen goods posted on the site. ikman has faced pranks more than fraud or crime in Sri Lanka. Pranksters post ads with someone else’s phone number and, in a few such cases, the police become involved, as the victim calls them instead of the ikman helpline. Alex also mentions pranks in which people post ads to sell a friend or their wife. The Colombo office also houses a 10-member marketing team focused on selling banner ads. Multinationals and banks have come onboard due to ikman’s visitor numbers. Financing and leasing companies, as well as banks, advertise on the vehicle and property pages, as they target a similar market. While this team brings in revenue, the latter task is not ikman’s main focus. Rather, it is maintaining its #1 position and growing with Internet penetration. But ikman is introducing revenue earners gradually. Currently, the top ads feature is its other earner, wherein users can pay to have their ad bumped to the top of the page, above the other hundreds posted on the site.

These developed market companies copy tried-and-tested models, but many adapt and modify them to local requirements. ikman has a 60-member team working with Sri Lankan car sales companies. These companies post on the site, accounting for a majority of ikman’s top ads revenue.

ikman is about to launch a couple of new products. “Nothing is official yet,” says Alex. “But there’s some exciting new stuff coming up. It’s nothing revolutionary because the classifieds business is no longer revolutionary. We’ll be launching concepts proven by classifieds sites elsewhere.”

ikman is about to launch a couple of new products. “Nothing is official yet,” says Alex. “But there’s some exciting new stuff coming up. It’s nothing revolutionary because the classifieds business is no longer revolutionary. We’ll be launching concepts proven by classifieds sites elsewhere.”

In a world where founders of new technologies and websites quickly become darlings of the media and consumers alike and earn millions, these copycat consumer website developers occupy a low rung. Most people view technology as innovative and disruptive, so the replication business model seems comparably less admirable. Whatever the purists’ view, taking models proven in developed markets and copying them in emerging markets is just as disruptive with regards to their effect on the latter. These websites are gradually moving consumers online, and the long-term effects on traditional commerce will be drastic.